A discussion of group term insurance is incomplete without an explanation of the tax laws affecting its use. While discussions of these laws are often limited to federal income and estate taxation, federal gift taxation and taxation by the states should also be considered.

Federal Taxation

The growth of group term life insurance has been greatly influenced by the favorable tax treatment afforded it under federal tax laws. This section is devoted to the effects of these tax laws on basic group term insurance and on coverages that may be added to a basic group term life insurance contract.

Deductibility of Premiums

In general, employer contributions for an employee's group term life insurance coverage are fully deductible by the employer under Code Section 162 as an ordinary and necessary business expense as long as the employee's overall compensation is reasonable. The reasonableness of compensation (which includes wages, salary, and other fringe benefits) is usually only a potential issue for the owners of small businesses or the stockholder-employees of closely held corporations. For income tax purposes, a firm may not deduct any compensation that the Internal Revenue Service (IRS) determines to be unreasonable. In addition, the Internal Revenue Code does not allow a firm to take an income tax deduction for contributions (1) that are made on behalf of sole proprietors or partners under any circumstances or (2) that are made on behalf of stockholders unless they are providing substantive services to the corporation. Finally, no deduction is allowed under Code Section 264 if the employer is named as beneficiary.

Contributions by any individual employee are considered payments for personal life insurance and are not deductible for income tax purposes by that employee. Thus, the amount of any payroll deductions authorized by an employee for group term insurance purposes is included in the employee's taxable income.

Employees' Income Tax Liability

In the absence of tax laws to the contrary, the amount of any compensation for which an employer receives an income tax deduction (including the payment of group insurance premiums) represents taxable income to the employee. However, Section 79 of the Internal Revenue Code gives favorable tax treatment to employer contributions for life insurance that qualifies as group term insurance.

Section 79 Requirements. To qualify as group term insurance under Section 79, life insurance must meet the following conditions:

- It must provide a death benefit excludable from federal income taxation.

- It must be given to a group of employees, defined to include all employees of an employer. If all employees are not covered, membership must be determined on the basis of age, marital status, or factors relating to employment.

- It must be provided under a policy carried directly or indirectly by the employer. A policy is defined to include a master contract or a group of individual policies. The term carried indirectly refers to those situations when the employer is not the policyholder but rather provides coverage to employees through master contracts issued to organizations such as negotiated trusteeships or multiple-employer welfare arrangements.

- The plan must be arranged to preclude individual selection of coverage amounts. However, it is acceptable to have alternative benefit schedules based on the amount an employee elects to contribute. Supplemental plans that give an employee a choice, such as either 1, 1½, or 2 times salary, are considered to fall within this category. An employee can be allowed to reject coverage in excess of $50,000 if he or she does not want any imputed income.

All life insurance that qualifies under Section 79 as group term insurance is considered to be a single plan of insurance, regardless of the number of insurance contracts used. For example, an employer might provide coverage for union employees under a negotiated trusteeship, coverage for other employees under an individual employer group insurance contract, and additional coverage for top executives under a group of individual life insurance policies. Under Section 79, these all constitute a single plan. This plan must be provided for at least ten full-time employees at some time during the calendar year. For purposes of meeting the "ten-life" requirement, employees who have not satisfied any required waiting periods may be counted as participants. Employees who have elected not to participate are also counted as participants—but only if they would not have been required to contribute to the cost of other benefits besides group term insurance if they had participated. As is described later, a plan with fewer than ten full-time employees may still qualify for favorable tax treatment under Section 79 if it meets more restrictive requirements.

Exceptions to Section 79. Even when all the previous requirements are met, there are some situations in which Section 79 does not apply. In some cases, different sections of the Internal Revenue Code provide alternative tax treatment. For example, when group term insurance is issued to the trustees of a qualified pension plan and is used to provide a death benefit under the plan, the full amount of any life insurance paid for by employer contributions results in taxable income to the employee.

There are three situations in which employer contributions for group term insurance do not result in taxable income to an employee, regardless of the amount of insurance: (1) if an employee has terminated employment because of disability, (2) if a qualified charity (as determined by the Internal Revenue Code) has been named as beneficiary for the entire year, or (3) if the employer has been named as beneficiary for the entire year.

Coverage for retired employees is subject to Section 79, and these persons are treated in the same manner as active employees. Thus, they have taxable income in any year in which the amount of coverage received exceeds $50,000. However, a grandfather clause to this rule stipulates that it does not apply to group term life insurance plans (or to comparable successor plans or plans of successor employers) in existence on January 1, 1984, for covered employees who (1) retired before 1984 or (2) were at least 55 years of age before 1984 and were employed by the employer any time during 1983. There is one exception to this grandfather clause; it does not apply to persons (either key or nonkey employees) retiring after 1986 if a plan is discriminatory.

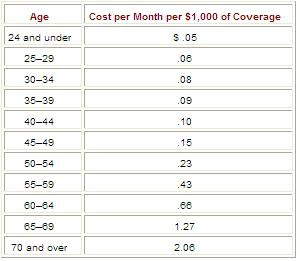

General Tax Rules. Under Section 79, the cost of the first $50,000 of coverage is not taxed to the employee. Because all group term insurance provided by an employer that qualifies under Section 79 is considered to be one plan, this exclusion applies only once to each employee. For example, an employee who has $10,000 of coverage that is provided to all employees under one policy and $75,000 of coverage provided to executives under a separate insurance policy would have a single $50,000 exclusion. The cost of coverage in excess of $50,000, minus any employee contributions for the entire amount of coverage, represents taxable income to the employee. For purposes of Section 79, the cost of this excess coverage is determined by a government table called the Uniform Premium Table I (see Table 1). This table was revised in 1999 with significantly lower costs.

To calculate the cost of an employee's coverage for one month of protection under a group term insurance plan, the Uniform Premium Table I cost shown for the employee's age bracket (based on the employee's attained age at the end of the tax year) is multiplied by the number of thousands in excess of 50 of group term insurance on the employee. For example, if an employee aged 57 (whose Table I monthly cost is $.43 per $1,000 of coverage) is provided with $150,000 of group term insurance, the employee's monthly cost (assuming no employee contributions) is calculated as follows

The monthly costs are then totaled to obtain an annual cost. Assuming no change in the amount of coverage during the year, the annual cost is $43 × 12, or $516. Any employee contributions for the entire amount of coverage are deducted from the annual cost to determine the taxable income that an employee must report. If an employee contributes $.25 per month ($3 per year) per $1,000 of coverage, the employee's total annual contribution for $150,000 of coverage is $450. This reduces the amount reportable as taxable income from $516 to $66. Note that if the employee contribution is $.30 rather than $.25 per month, the annual employee contribution in this example is $540. Because $540 exceeds the Table I cost, there is no imputed income.

One final point is worthy of attention. The use of Uniform Premium Table I results in favorable tax treatment for the cost of group term insurance when the monthly costs in the table are lower than the actual cost of coverage in the marketplace. However, group term insurance coverage can often be purchased at a lower cost than Table I rates. There are some who argue that in these instances the actual cost of coverage can be used in place of the Table I cost for determining an employee's taxable income. From the standpoint of logic and consistency with the tax laws, this view makes sense. However, the regulations for Section 79 are very specific: Only Table I costs are to be used.

Nondiscrimination Rules. Any plan that qualifies as group term insurance under Section 79 is subject to nondiscrimination rules, and the $50,000 exclusion will not be available to key employees if a plan is discriminatory, defined as a plan that favors key employees in either eligibility or benefits. In addition, the value of the full amount of coverage for key employees, less their own contribution, will be considered taxable income, based on the greater of actual or Table I costs.

A key employee of a firm is defined as any person who at any time during the current plan year or the preceding four plan years is any of the following:

- An officer of the firm who earns from the firm more than 50 percent of the Internal Revenue Code limit on the amount of benefits payable by a defined-benefit plan. This amount (50 percent of $135,000, or $67,500, for 2000) is indexed annually. For purposes of this rule, the number of employees treated as officers is the greater of three employees or 10 percent of the firm's employees, subject to a maximum of 50. In applying the rule the following employees can be excluded: persons who work part time, persons who are under age 21, and persons with less than six months of service with the firm.

- One of the ten employees owning the largest interest in the firm and having an annual compensation from the firm of more than $30,000.

- An individual who owns more than 5 percent of the firm.

- An individual who owns more than 1 percent of the firm and who earns over $150,000 per year.

Note that the definition of key employee includes not only active employees but also retired employees who were key employees at the time of retirement or separation from service.

Eligibility requirements are not discriminatory if (1) at least 70 percent of all employees are eligible, (2) at least 85 percent of all employees who are participants are not key employees, (3) participants constitute a classification that the IRS determines is nondiscriminatory, or (4) the group term insurance plan is part of a cafeteria plan and Section 125 requirements are satisfied. For purposes of the 70 percent test, employees with less than three years' service, part-time employees, and seasonal employees may be excluded. Employees covered by collective-bargaining agreements may also be excluded if plan benefits were the subject of good-faith bargaining.

Benefits are not discriminatory if neither the type nor amount of benefits discriminates in favor of key employees. It is permissible to base benefits on a uniform percentage of salary.

Groups with Fewer than Ten Full-Time Employees. A group insurance plan that covers fewer than ten employees must satisfy an additional set of requirements before it is eligible for favorable tax treatment under Section 79. These rules predate the general nondiscrimination rules previously described, and it was assumed that the "under-ten" rules would be abolished when the new rules were adopted. However, that was not done, so smaller groups are subject to two separate and somewhat overlapping sets of rules. Again, note that Section 79 applies to an employer's overall plan of group insurance, not to separate group insurance contracts. For example, an employer providing group insurance coverage for its 50 hourly employees under one group insurance contract and for its six executives under a separate contract is considered to have a single plan covering 56 employees and thus is exempt from the "underten" requirements. While the stated purpose of the "under-ten" requirements is to preclude selection of coverage by individual employees, their effect is to prevent the group insurance plan from discriminating in favor of the owners or stockholder-employees of small businesses.

With some exceptions, plans covering fewer than ten employees must provide coverage for all full-time employees. For purposes of this requirement, employees who are not customarily employed for more than 20 hours in any one week or five months in any calendar year are considered part-time employees. It is permissible to exclude full-time employees from coverage under the following circumstances:

- The employee has reached age 65.

- The employee has not satisfied the plan's probationary period, which may not exceed six months.

- The employee has elected not to participate in the plan, but only if the employee would not have been required to contribute to the cost of other benefits besides group term life insurance if he or she had participated.

- The employee has not satisfied the evidence of insurability required under the plan. An employee's eligibility for insurance (or the amount of insurance on the employee's life) may be subject to evidence of insurability. However, this evidence of insurability must be determined solely on the basis of a medical questionnaire completed by the employee and not by a medical examination.

The amount of coverage must be a flat amount, a uniform percentage of compensation, or an amount based on different employee classifications. These employee classifications, which are referred to as coverage brackets in Section 79. The amount of coverage for each employee in any classification may be no greater than 2½ times the amount of coverage provided to each employee in the next lower classification. In addition, each employee in the lowest classification must be provided with an amount of coverage that is equal to at least 10 percent of the amount for each employee in the highest classification. There must also be a reasonable expectation that there will be at least one employee in each classification. The benefit schedule shown in Table 2 is unacceptable for two reasons. First, the amount of coverage provided for the hourly employees is only 5 percent of the amount of coverage provided for the president. Second, the amount of coverage for the supervisor is more than 2½ times the amount of coverage provided for the hourly employees. The benefit schedule in Table 3, however, is acceptable.

If a group insurance plan that covers fewer than ten employees does not qualify for favorable tax treatment under Section 79, any premiums paid by the employer for such coverage represent taxable income to the employees. The employer, however, still receives an income tax deduction for any premiums paid on behalf of the employees as long as overall compensation is reasonable.

0 comments:

Post a Comment